Billboards are up!

And a bunch of other things you'll want to know.

Executive summary

A collection of short takes (for a change).

“Until Proven Otherwise” video

If you haven’t seen this, please watch and give it a “like” and retweet it please! Thank you!

Billboards are now up outside CDC headquarters

Click over and give it a Like:

Here’s the context:

This billboard is now up too:

Both are a short distance from CDC headquarters in Atlanta.

Next, I emailed about 300 people at the CDC involved in vaccine safety just to make sure they are aware of it.

Andrew Wakefield’s favorite billboard

The CDC tells the truth… finally! Apparently, the CDC is putting these up all over America. Let me know if you see one in your neighborhood.

All I can say is “it’s about time!”

An offer to laid off Twitter employees looking to make some money

I was permanently banned (twice) from Twitter for saying that the COVID vaccines cause prion diseases and cancers come back with a vengeance after COVID vaccination. Clearly, Twitter must think this is misinformation, but I can’t figure out why on either of these. I’ll happily pay you for your time if you can show me the evidence showing I was wrong.

I made have made a mistake: the smallpox vaccine could be more dangerous than the COVID vaccine

Silly me. I assumed people were telling the truth that the smallpox vaccine kills 1 person per million. How could I have been so naïve? The authorities claim that the COVID vaccines have not injured or killed anyone. It’s clear that this is off by at least 5 orders of magnitude.

So when they have a vaccine like the smallpox vaccine which they admit kills too many people to be safe, it could very well kill tens of thousands of people per million, not one. So my statement that the COVID vaccines are the deadliest vaccines in human history may be inaccurate. I haven’t looked into it. If anyone knows, please use the contact me link. Thanks!

Aseem Malhotra is teaming up with John Campbell

It seems like Campbell now knows what is going on, but he has to play dumb on his channel or YouTube will kick him to the curb. So he’ll say something like “Isn’t that interesting?” or something to that effect.

But I just saw this:

which references this event:

Stanford pediatrician assures my wife that I am not a whack job

A Stanford pediatrician who has figured out what is going on contacted my wife and let her know that I am not a whack job. She/he swore my wife to secrecy. He/she fears loss of job and/or medical license if his/her identity was revealed.

So even though I can’t divulge the source, it’s somewhat reassuring to know I am not a whack job.

Errata bounty is $200 for Fauci, $1,000 for Turtles

There have been 6 errors reported in the Fauci book, 0 for Turtles. I had to reduce the bounty paid for the Fauci book to $200 per error. The bounty for Turtles errors is still at $1,000.

Low Dose Naltrexone (LDN)

Ryan Cole was on Clubhouse after the VSRF meeting talking about using LDN if you’ve been vaccinated to reduce the chance of inflammation causing harm.

He suggests starting with .5mg one hour before bedtime, ramping up by .5 mg every week and leveling off at 4.5mg.

He considers this very safe and something that can benefit everyone, even if you aren’t ill.

For more info, here’s a reference.

I’ve upgraded my video gear

I bought a Blackmagic Pocket Cinema camera 4k (BMPCC) for my video calls and an ATEM Mini which I highly recommend due to the additional controls it gives you over the camera. I ran into a screen tearing problem with the ATEM Mini USB C video output that nobody knew how to solve. I posted the solution here. Hopefully, it helps someone else.

I’ve been using Davinci Resolve for editing my videos so this was a natural extension of this. Blackmagic makes incredible products and an incredible array of products.

I also learned how to use vmix which is an awesome program. I love the vectorscope and parade video patterns that you can see on each video feed… none of the low-end tools have that. It was a breeze to set up my camera by feeding them into vmix and then using the scopes on the waveforms.

I also switched from riverside.fm to Squadcast for my interviews. Like Riverside, Squadcast also does local recordings so you get full video resolution of both parties.

Vmix also allows me to do video interviews, but it’s a little harder to use.

The collapse of FTX

If you are not into crypto, you can skip this section…

I got caught in the FTX fiasco. I was able to withdraw some funds, but other withdrawals “could not be completed at this time.”

So even though they said “withdrawals are not affected” that was a lie too.

Bottom line: Diversify your holdings now.

Turns out they were using customer funds for their own trading and they lost $10B of their customer’s funds. Wow. No auditor said anything about that?

If you think your money is safe at Coinbase, think again.

This email from Scott Purcell is eye-opening (the rest of this section is his email):

FTX today. Celsius and BlockFi yesterday. Why? Will there be more? Yes.

First the "why?", then I'll discuss "who's next?" (yes, there will be more).

Why? A combination of greed & incompetence on the part of crypto exchanges, lenders and OTC desks combined with improper (or lack of) regulation.

It all comes down to this: "balance sheet assets".

Explain: In the US we see crypto exchanges and others obtaining simple money-transmitter licenses and holding investor assets (cash, crypto, securities, NFTs, etc) on their balance sheets. Offshore, these entities have either no licenses or money-transmitter-type licenses that also permit them to hold customer assets on balance sheet. This means those assets are the property of the exchange (or lender). Customers are just unsecured liabilities on the that balance sheet. Now, since these are company assets the company can use those for its benefit. They can lend them, invest them, and do other things to juice corporate returns...which, of course, can go down in flames. And if a company goes out of business then others may have a superior claim on those assets over investors, including the government (taxes, fines), debt holders, and secured vendors. Customers get whatever might be left, if anything.

In the case of FTX, they are short $10B. This means that they made investments with the assets on the balance sheet to try and make money for the company (not customers), then those investments obviously went south and now there aren't enough assets to cover investor accounts (unsecured liabilities on the balance sheet).

=> The CEO says "oops, sorry, I f***'d up", which is true to the tune of $10B...but never should have been permitted by regulation in the first place.

Regulation of entities who hold customer assets:

There are 3 types of "qualified" custodians -

Trust companies

Banks

Clearing brokers

Of those...

=> Trust companies and clearing brokers can <<NOT>> hold customer assets on balance sheet. They have to hold them "FBO" (for benefit of) customers. They can not comingle customer cash or other assets with company cash or assets. They have to be segregated. They can not be used or misused. And no third-party creditors have any claim on them. If a trust company or clearing broker fails, their regulator (banking commissioner or OCC for a trust company, FINRA for a clearing broker) steps in and ensures an orderly transfer of assets to another financial institution. 100% of assets.

=> Banks can hold customer assets on their balance sheet, and they can invest them to make profits. This includes lending, stocks, bonds, life insurance pre-funds, credit card advances, letters of credit, etc. All using customer assets. If a bank makes terrible investments and fails, then in this case the FDIC steps in and makes up the difference between assets on the banks balance sheet vs customer liabilities (up to $250,000). This is why the FDIC has onerous regulations on what banks can and cannot invest in, and how much of their balance sheet they can invest into any particular thing no matter how good it seems. It is tightly restricted, controlled and regulated.

And of those, clearing brokers generally don't hold private securities or tokenized assets (including cryptocurrency). There are a variety of deliberate and nuanced regulations that make it impractical for them to do this. Banks can not hold tokenized assets on their balance sheets, only in their trusts, and while a very few of those hold the common forms of cryptocurrency (BTC, ETH), none hold the vast array of cryptocurrency, private securities, real estate interests, or tokens representing rewards programs, health care records, event tickets, collectibles, etc. That leaves trust companies as the only qualified custodian.

Money Transmitters -

Here's where a regulatory loophole is resulting in tens-of-billions of dollars in consumer losses. A money-transmitter is a state-by-state licensed entity that was originally intended for firms moving small amounts of cash point-to-point between people (which might very temporarily land in the money transmitters account). Money transmitters carry these customer assets on their balance sheet, as opposed to trust co's and clearing brokers who do not. Thus the crypto industry has leveraged this loophole to get "licenses", and these licenses enable them to hold assets on their balance sheets and thus they can do stupid things with other peoples money. Regulation is enabling this behavior.

Who's Next?

Ah, the multi-billion dollar question. There will be others. FTX is a big shoe, as was Celsius and BlockFi. Brace yourself for more.

Example?

Lets talk about Coinbase. "A note to the financial statements explains that as of June 2022, Coinbase has taken all customer assets on to its own balance sheet...it still has $12bn of its own and customers' cash (both on its balance sheet)."

The first thing that hit me when I read that was "why the heck would they do that???!!!" They own a trust company, so why wouldn't they just keep all customer cash and crypto at their trust company to ensure it's safeguarded and protected. Why the heck would they put all those assets on the exchange, which only has money-transmitter licenses? The only reason I can think of is that they can't use other peoples money/crypto for their own benefit if it's at the trust company, but only if it's at the exchange. Maybe there is something else, but I don't see it. So the natural question is "okay, so what exactly are they doing with those customer assets?" Possibly no different than what FTX was doing, maybe not, who knows for sure.

They might say "oh the assets are protected under UCC Article 8", but my understanding is that really is meant to apply to securities and even then just attempts to put customer balance sheet liabilities ahead of other creditors on available assets in the event of failure of the company...it does not prevent the company from using customer cash and assets for its own interests and potentially losing those a la FTX. So Article 8 wouldn't matter much even if it is held to be applicable in a disaster scenario.

And others?

Yes, any firm operating as a simple money-transmitter, what I call a pseudo-custodian, is capable of doing these things. That's all crypto exchanges who don't use a trust company, whether their own or independent, all crypto lenders, etc.

I have a lot of respect for the team at Coinbase, as well as Binance.us, Zero Hash, Bittrex, and other such money transmitters. I have no idea if they've used/misused customer assets or done anything stupid or wrong. Maybe they are safe and perfect. But when you are permitted by lax regulation to use customer assets for your benefit, greed almost always prevails.

Protect Yourself:

How? Easy. If you have cash, crypto, NFTs, or other assets at any of these psuedo-custodians who operate with money-transmitter licenses...get it out of there. Now. Right now. Move it to a qualified custodian or to self-custody. Don't walk...run...right now.

Next Steps for the Industry?

Regulation is (finally) coming. Legislation is coming. We...as an industry...don't want another Dodd-Frank or Sarbanes Oxley knee-jerk reaction that overcorrects a problem. I've got the CEO of Fortress Trust, Albert Forkner, former Banking Commissioner and Chairman of the State Bank Supervisors going out to work with members of Congress including Senators Lummis and Gillibrand and Representatives McHenry and Waters as they craft legislation, and to work with the SEC, CFTC, CFPB and other government agencies on sensible regulation.

And I pray that the states modify their money-transmitter regulations to immediately retract/cancel licenses from any out-of-state entity other than trust companies, banks and clearing brokers.

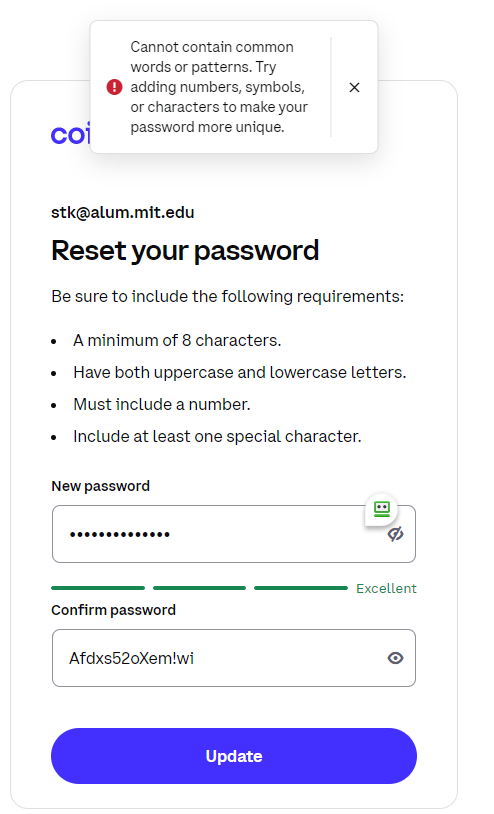

My Coinbase password reset

Following the demise of FTX, I decided to check to see if the $10 I still have in Coinbase is safe. It said I had to change my password before I logged in.

This ended up being much harder than I thought. Check this out:

It’s impressive that a random sequence of characters banged on a keyboard is a common word or pattern!

OK, I tried to set it to something completely different but that failed as well with the same error:

OK, so apparently a lot of people chose THAT password.

As Groucho Marx would have said, “It’s a common word, something you’d find around the house.”

This basically FORCES you to write down your impossible to remember password somewhere along with your other passwords creating a honeypot of passwords for hackers to find. Great security.

So I again randomly typed on the keyboard and again, failure:

All of these passwords gave the “too common” error:

vVJ9oeo7DxH#Zi$

vVJoTye7DH#Zi$dfkljs023jk23m089uyasvmnalasdfai920354jma09fasd8fuyan2o3nmvap2l

mnbtr34kl^msdf98JMoiiojasdfgmoiadfmgaoigdfaouisdo8pp43qpjngorinsfdoghnsdfogfnd0g98sdfgjsfdggsds

The solution? There is some bug… this is the wrong password reset page. The correct one (the link they send in the email) doesn’t let you see your passwords. Using that link worked.

Summary

Let me know what you think of this style of article (lots of short snippets):

Thanks!

I live near the CDC - those billboards are not only near the CDC, but also right next to Emory University and Hospital, Children’s Healthcare of Atlanta, the VA Hospital and in the heart of deep blue (vax me more) part of Atlanta. I bet you’re striking a chord with many. Congratulations!

True Story. My brother was in the Airforce and had to get the required flu shot every year for 20 years. Every year he would get the flu anyway, for 20 years. When he retired, he thought "What the heck?" and decided not to get the flu shot. After that he never got the flu for another 20 years.